In the dynamic landscape of investment opportunities, Small and Medium-sized Enterprises (SMEs) have emerged as a compelling choice for investors seeking to diversify their portfolios and tap into high-growth potential. However, it is crucial to acknowledge and carefully assess the associated risks before making investment decisions.

BENEFITS OF INVESTING IN SMEs

High Growth Potential:One of the primary attractions of SMEs for investors is their remarkable growth potential. Unlike larger, more established companies, SMEs possess agility and adaptability, allowing them to scale rapidly and respond effectively to changing market conditions. A classic example of this is the evolution of Boulder, Colorado, which saw federal laboratories settling in the 1960s. This partnership with the University of Colorado resulted in the establishment of research institutions and the emergence of 12 active start-up accelerators and incubators, making Boulder one of the top 30 start-up ecosystems globally. |  |

| Portfolio Diversification:Investing in SMEs offers investors the opportunity to diversify their portfolios, mitigating the risks associated with concentrating investments in a single industry or asset class. The Colorado tech sector, employing 9.7 percent of the state's workforce and contributing 14 percent to its economy, showcases the positive impact of such diversification strategies. |

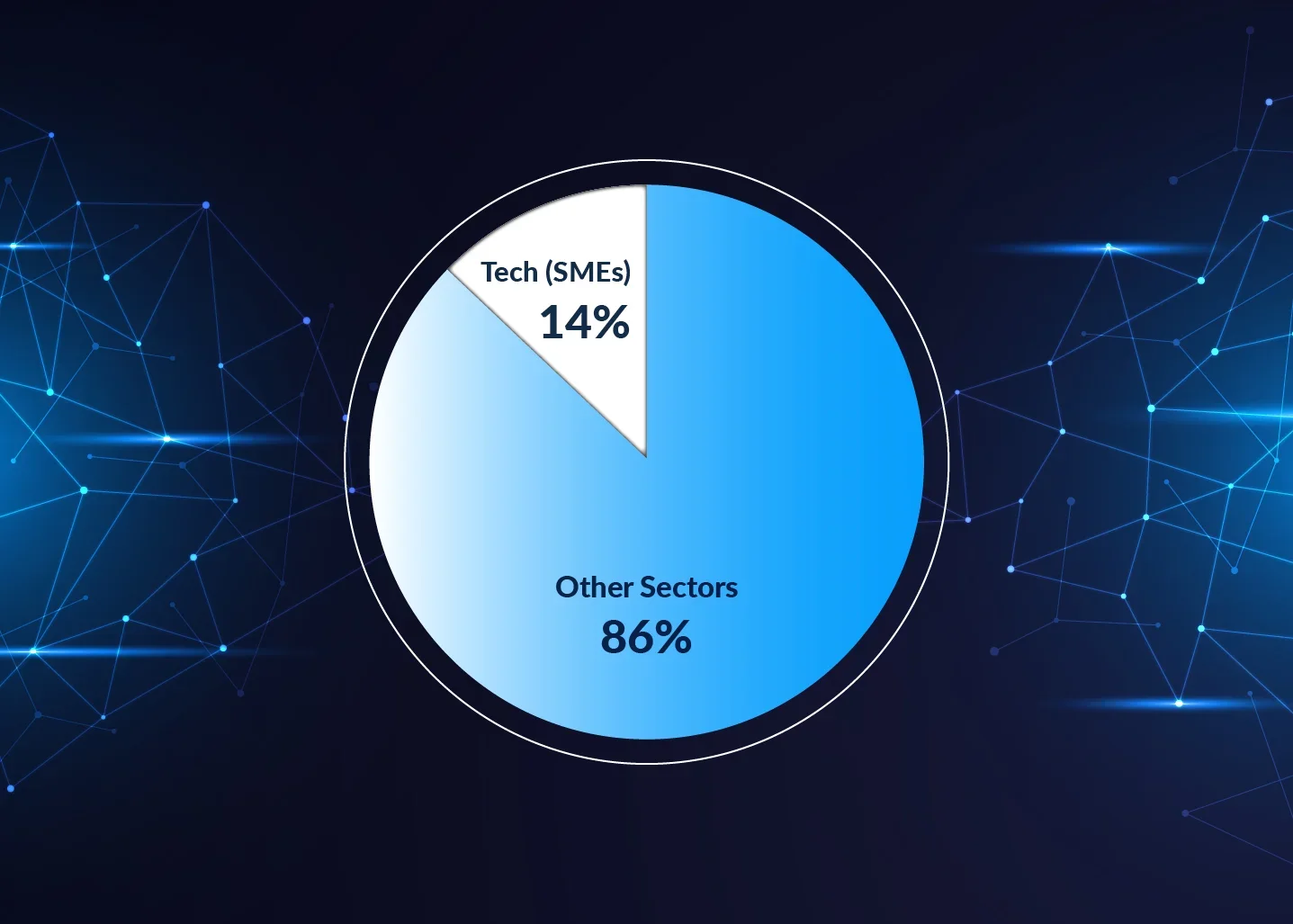

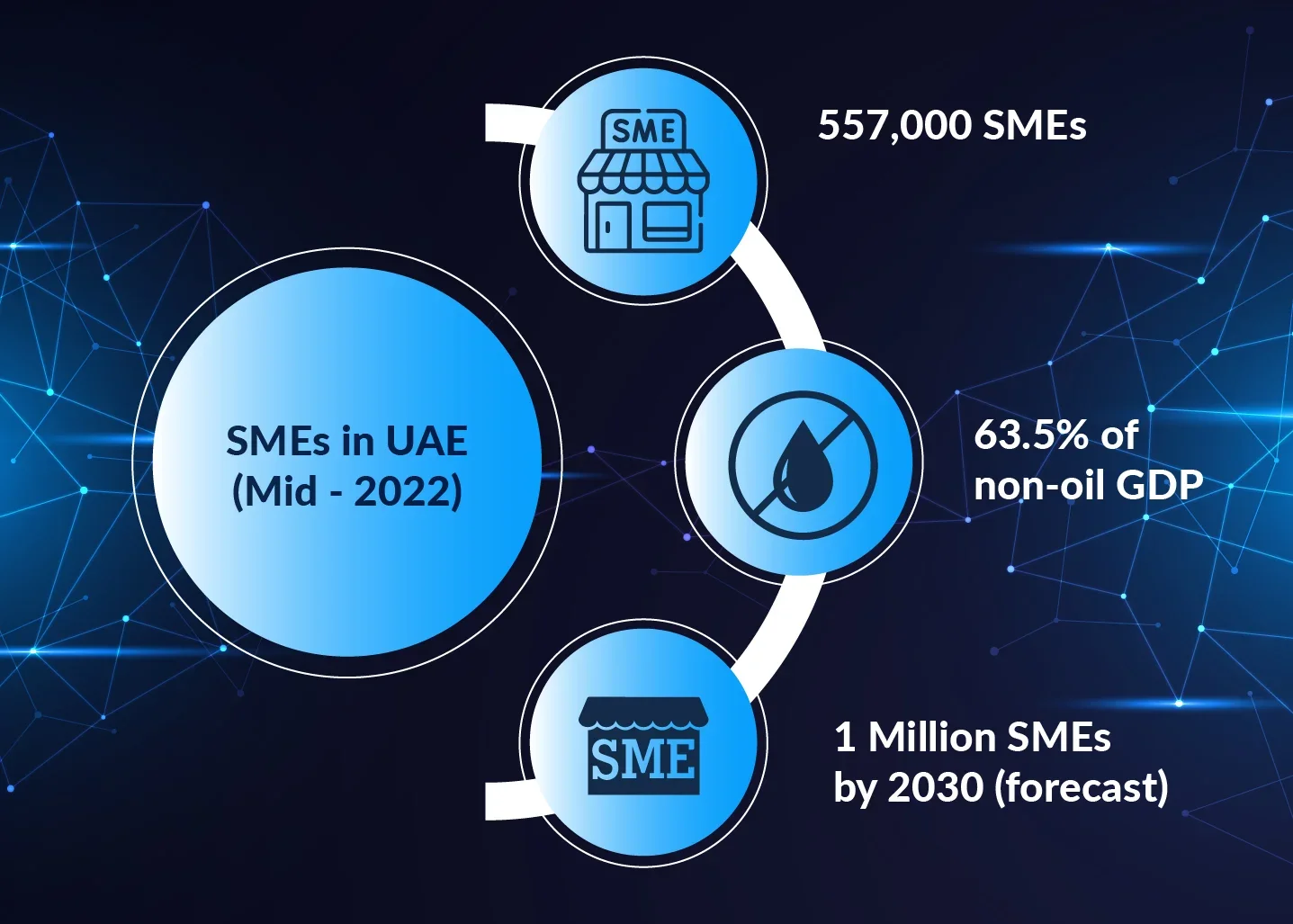

Economic and Social Impact:Beyond financial gains, investing in SMEs contributes significantly to economic growth and job creation. SMEs form the backbone of many economies, as exemplified by the UAE's commitment to supporting them. The UAE government's emphasis on SMEs through initiatives like the National SME Programme, the UAE SME Council, Operation 300bn, and others underscores their importance in building national human resources and fostering economic diversification. As of mid-2022, the UAE boasted 557,000 SMEs, contributing 63.5 percent to the non-oil GDP. Forecasts predict a surge to 1 million SMEs by 2030, highlighting the government's commitment to nurturing these enterprises. |  |

Access to Innovative Business Models:

SMEs are often pioneers in developing cutting-edge products and services that disrupt established industries. This innovation not only benefits investors but also contributes to overall industry advancement. The Future Industries Lab in the UAE, run by the Ministry of Industry and Advanced Technology, exemplifies this by enhancing the technical skills of SMEs and aligning them with cutting-edge technologies.

The AIM Congress, scheduled for May 7-9, 2024, at the Abu Dhabi National Exhibition Centre, stands out as the go-to place for SMEs seeking new sources of funding and financing solutions.

RISKS AND CHALLENGES

Despite their appeal, SME investments come with inherent risks. Illiquidity, limited information and transparency, management risk, and regulatory challenges are factors that investors must carefully consider. For instance, the illiquidity of SME investments can pose challenges as these businesses often lack a public exchange for trading shares, making it harder for investors to sell holdings quickly.

During the AIM Congress, global leaders come together to explore the future of SMEs and startups. With key stakeholders in close proximity, the opportunity to engage in conversations and anticipate risks and challenges is ever-present.

GOVERNMENT SUPPORT FOR SMEs IN THE UAE

To counterbalance these risks, the UAE government has implemented several measures to support SMEs. Federal Law No. 2 of 2014 protects, promotes, and regulates SMEs, while the National SME Programme and the UAE SME Council provide strategic plans, policies, and coordination to enhance SME development. Operation 300bn contributes to financing 13,500 SMEs, and the Khalifa Fund, operating since 2007, provides a range of services, including business counseling, financial support, and incubation to Emiratis.

For instance, the Khalifa Fund, with a capital that grew from AED 300 million to AED 2 billion, has been pivotal in supporting SMEs across the UAE. It offers a suite of services, including business counseling, financial support, technical guidance, and incubation, demonstrating a comprehensive approach to nurturing SMEs.

AIM Congress 2024: SME Funding Hub

As the landscape of SME investments evolves, opportunities for collaboration and growth continue to expand. AIM Congress plays a strategic role in helping SMEs present their business value and competitiveness to investors, helps them navigate challenges and harness the full spectrum of opportunities.

The AIM Congress is dedicated to elevating SMEs in key sectors like Food and Beverage, Cosmetics, Fashion, Textile, Apparel, and Handicrafts. From promoting innovative products in the food industry, including coffee, tea, and chocolates, to empowering cosmetics and fashion SMEs in skincare, makeup, and apparel, AIM provides a platform for growth and collaboration. The congress emphasizes the diverse craftsmanship of SMEs in handicrafts, spanning woodcrafts, paper crafts, candles, glass crafts, carpets, clay, and paintings. AIM Congress strategically focuses on these sectors, fostering innovation and supporting SMEs to thrive in dynamic markets.