In the ever-changing realm of global economics, Foreign Direct Investment (FDI) remains a key driver of growth and development. As we step into the new year, 2024, the landscape of FDI is marked by dynamic shifts influenced by geopolitical tensions, macroeconomic conditions, and technological advancements.

AIM Congress, in this blog, takes a look at the top five trends shaping the FDI outlook for the coming year.

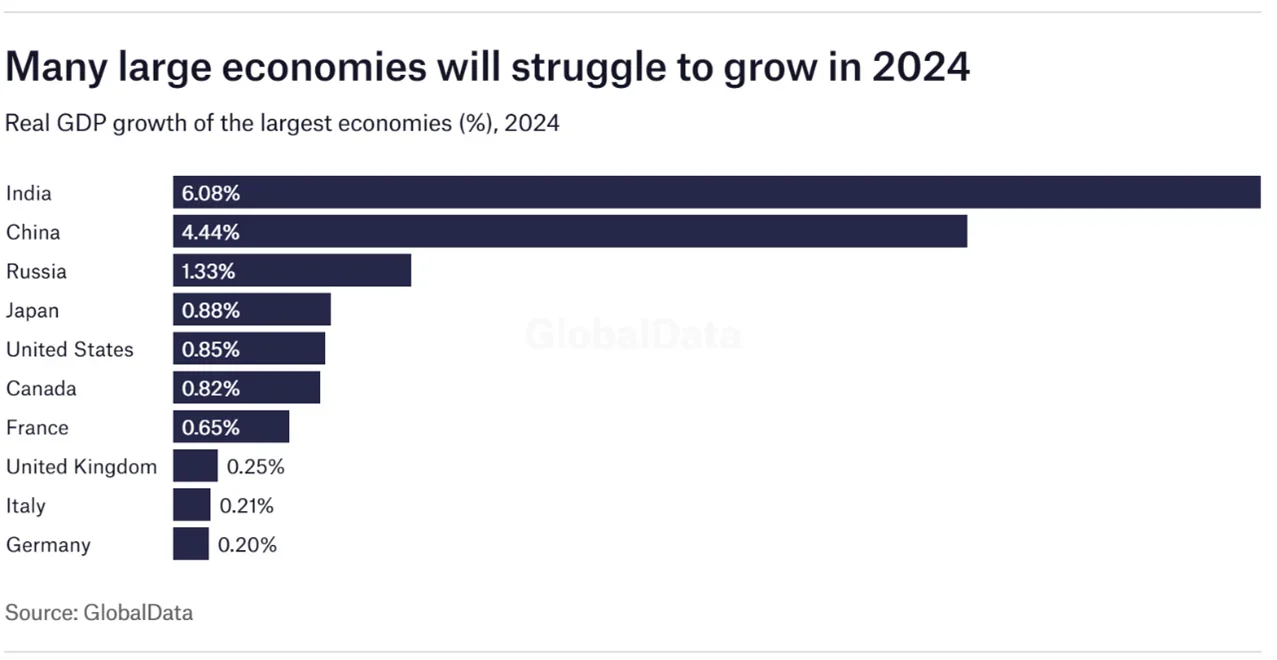

1. Geopolitical and Macroeconomic UncertaintiesThe FDI landscape for 2024 is clouded by geopolitical and macroeconomic uncertainties. According to the FDI Intelligence, these uncertainties continue to pose challenges, but nuances in the global economic cycle offer a less gloomy outlook, especially for developing economies. The IMF projects a modest growth of 1.4% in advanced economies, prompting multinational enterprises to seek opportunities in faster-growing developing economies. |  |

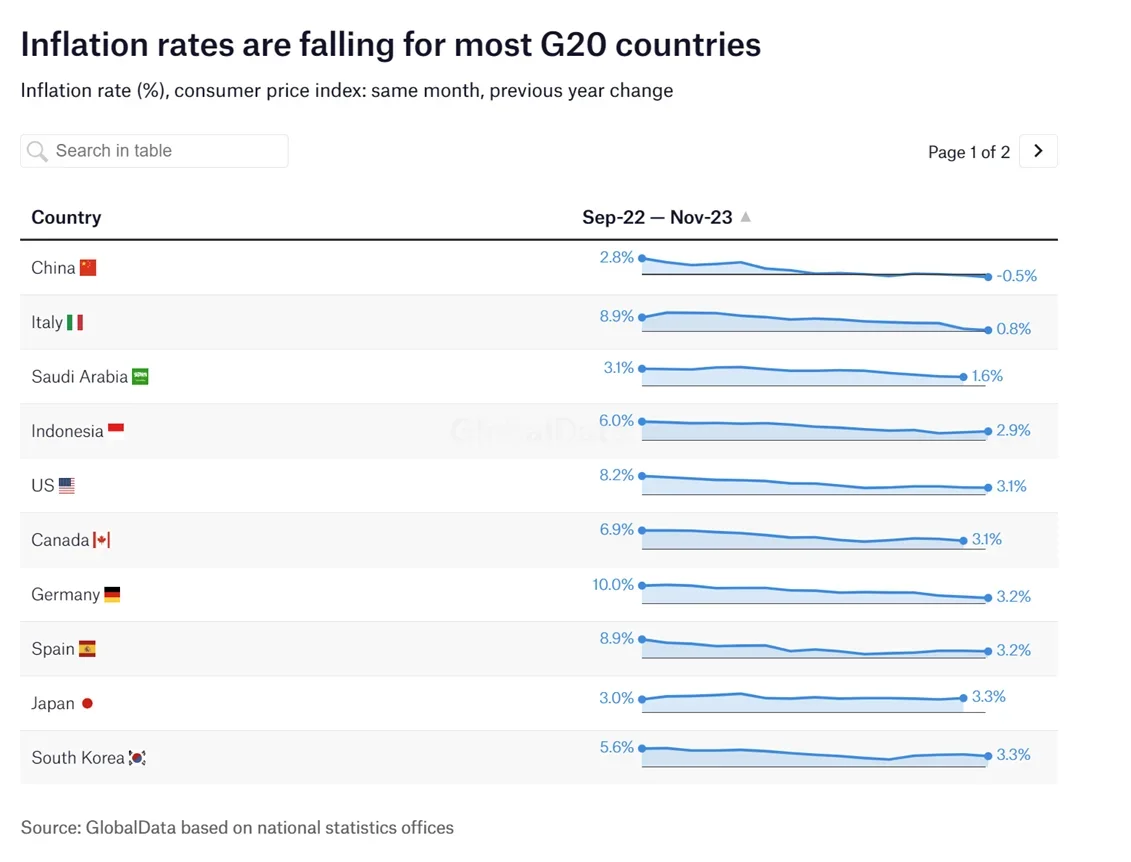

| 2. The Impact of Interest Rates and the Return of BondsFor investors eyeing 2024, the impact of interest rates cannot be overstated. Forbes points out that the US Federal Reserve's four interest rate hikes in 2023 have influenced investment strategies. While cash appeared to be king due to high-interest rates, multiple bank failures led to a shift in focus towards the stock market. The return of bonds in 2024 is anticipated as interest rates are expected to decrease in the US and Europe. |

3. Resource-Rich Regions and Asia's FDI Outlook

Resource-rich regions, particularly in Africa and the Middle East, continue to attract substantial FDI in 2024. According to FDI Intelligence, the three 'geos' — geography, geology, and geopolitics — make natural resources a focal point for investments. Growth is projected to accelerate in Sub-Saharan Africa and the Middle East, highlighting the significance of these regions in the FDI landscape.

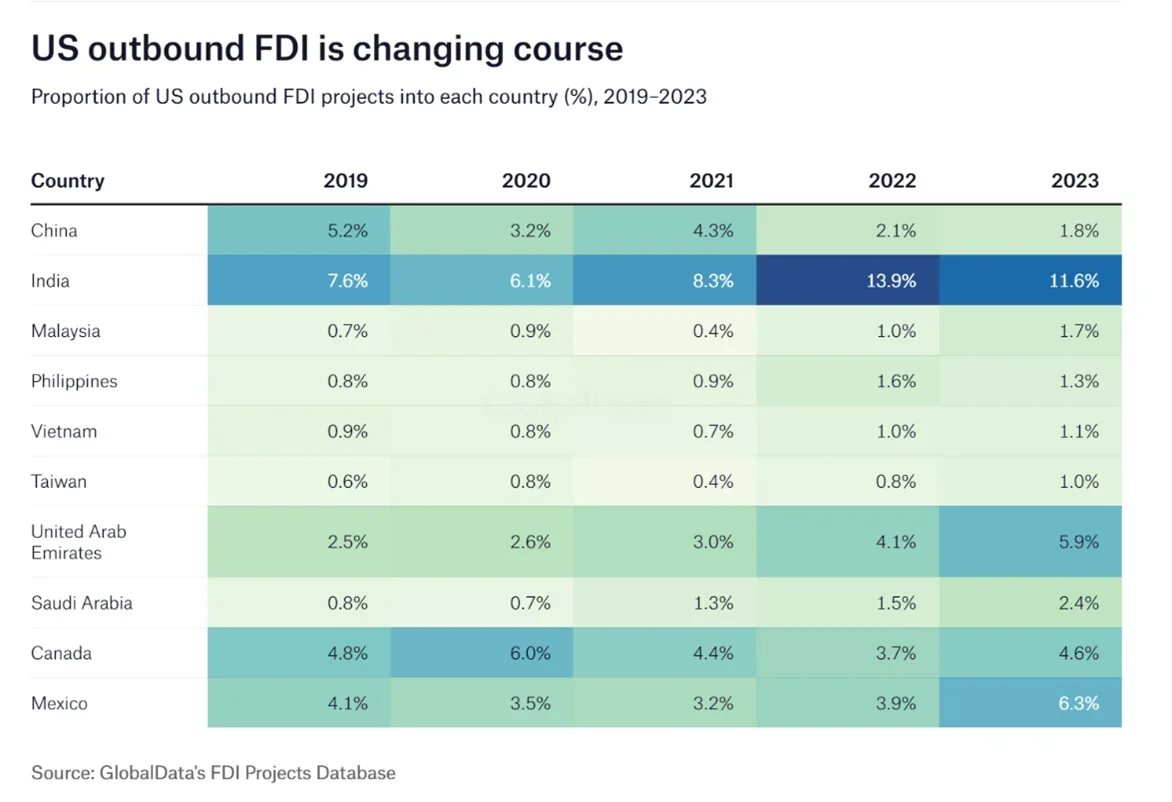

In Asia, the outlook is nuanced. Despite China's economic slowdown, there is optimism. Lawrence Yeo, CEO of consultancy AsiaBIZ Strategy, suggests that Asia's FDI outlook can find a silver lining in stronger regional trade and ongoing reorganization of China-centric value chains.

4. AI, Clean Energy, and Reshaping Industries

As we progress into 2024, technological advancements play a pivotal role in FDI trends. Investment Monitor's analysis indicates a continued focus on artificial intelligence (AI) and clean energy. The AI market is projected to be worth $909 billion in 2030, with companies investing in foreign offices and research centers. Additionally, the recent COP28 meetings underscore the importance of foreign companies leading the energy transition.

5. Changing Investment PatternsFor investors eyeing 2024, a shift in investment patterns is evident. Forbes suggests a focus on mid- and small-cap stocks trading at a discount to historical rates. This diversification is seen as an opportunity to unlock growth in companies well-positioned for policy easing and post-pandemic supply chain improvements. Direct indexing emerges as a savvy strategy for 2024. Cyrus Amini, CFA, and CIO at Helium Advisors, emphasizes the benefits of direct indexing for personalization, cost-effectiveness, and diversification away from S&P 500 heavyweights. |  |

AIM Congress 2024’s predictions

As we anticipate the FDI landscape of 2024, it's evident that challenges and opportunities coexist. Geopolitical uncertainties and macroeconomic conditions present hurdles, but nuanced shifts offer a more optimistic outlook. Investors are encouraged to consider the impact of interest rates, explore opportunities in resource-rich regions, stay abreast of technological trends, and embrace changing investment patterns.

The evolving FDI landscape in 2024 requires adaptability and a keen understanding of global dynamics. As the year unfolds, investors equipped with a comprehensive understanding of these trends will be better positioned to navigate the complex terrain and capitalize on emerging opportunities.

AIM Congress 2024 and FDI

The AIM Congress 2024 stands out as a beacon for global economic prosperity, distinguished by its innovative features. In the investment track, under the theme, “Resilient, Sustainable Economic Growth: Creating a Healthy and Prospective Investment through FDI and FPI,” the key focus will be on FDI, one of the six pillars of AIM Congress 2024.

The AIM Congress 2024 is set to be an unparalleled convergence of industry leaders and visionaries, featuring comprehensive offerings across diverse sectors such as Technology, Energy, Finance, Agriculture, Healthcare, Manufacturing, and Transportation. This dynamic event will encompass Workshops, Conferences, Exhibitions, Awards, Investors Hub, Investment Destination showcases, and specialized Regional Focus Forums. Facilitating critical connections, the congress will also host Government-to-Government (G2G), Government-to-Business (G2B), and Business-to-Business (B2B) meetings, fostering collaborative opportunities. With an expansive array of features, AIM Congress 2024 promises an immersive experience, driving innovation, investment, and transformative dialogues across the global business landscape.

Supported by the UAE Ministry of Industry and Advanced Technology and partnered with the Abu Dhabi Department of Economic Development, AIM Congress 2024 invites stakeholders from around the world to participate in this unparalleled convergence of global leaders and visionaries, taking place in Abu Dhabi from May 7 to 9, 2024. The event promises to be a catalyst for economic growth and expansion, offering a unique opportunity to foster collaboration and address global challenges for the benefit of nations worldwide.