Agricultural exporters from the United States are facing greater competition from countries that have entered multilateral trade agreements with important U.S. trading partners. This competition is occurring globally, but with significant implications across Asia, especially within the 10 countries in the Association of Southeast Asian Nations (ASEAN).

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has been ratified by 10 countries, including 3 in ASEAN, with Thailand, the Philippines, and Indonesia expressing interest in joining the bloc. The agreement eliminates tariffs on over 90% of goods traded, including many agricultural commodities that the United States exports to ASEAN countries. In 2021, the United States exported $14.3 billion in agricultural goods to ASEAN and while the country will continue to be a large supplier of wheat, cotton, and soybeans, there is growing competition. One area that is seeing significant competition is fresh and dried fruits.

Thailand has not yet joined the CPTPP, but it has entered into bilateral trade agreements with Chile, Peru, Australia and New Zealand. With its population of 71.8 million and average annual income of $7,000 GDP per capita, Thailand remains a strategic market for U.S. exporters. Thailand was the 14th largest destination for agricultural exports in 2021, which totaled $1.7 billion in trade. The value of U.S. fruits exported in the same year was $59 million, and while the market share enjoyed by the United States is under threat, opportunities exist for exporters to further improve their long-term market competitiveness.

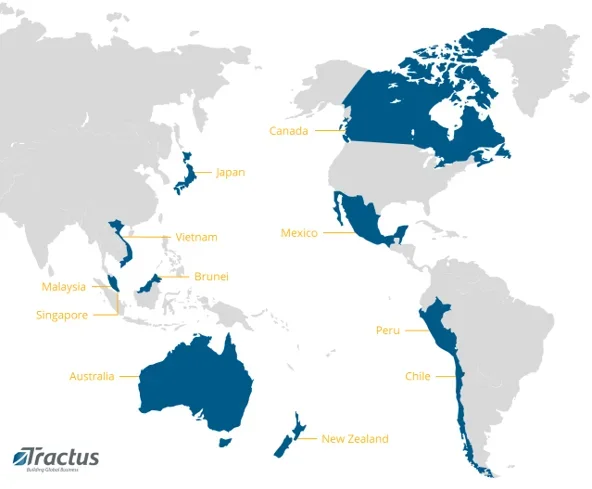

CPTPP's 11 members

Can U.S. Exporters Compete with Lower Priced Competition from Chile and Peru?

Supermarket aisles and convenience stores across ASEAN markets are seeing a greater supply of dried fruits from Chile and Peru. Chile’s exports of fruits and nuts to ASEAN totaled $65 million in 2021, up from $44 million in 2020. At $24 million in 2021, Peru’s exports of fruits and nuts are lower than Chile’s but have remained largely steady throughout the pre and post-pandemic era.

Thailand is a strategic market for both countries. Exporters of fruits and nuts from Chile reached $23 million in 2021, up 15% from the previous year, while Peru’s were $14.3 million. U.S. exports on the other hand have declined by 21% from 2020 to 2021, although the United States still enjoys a larger market presence, exporting $59 million worth of fruits and nuts to Thailand in 2021.

Dried fruits that are exported from Chile and Peru enter the markets as bulk commodities where they are repackaged by national distributors. Exports of dried fruits from the United States, however, enter the market as finished goods that are then sold to retail locations. The repackaged dried fruit is the primary area where Chile and Peru are capturing U.S. market share. Competing in this sector is primarily a cost factor, and the costs of goods from Chile and Peru are substantially lower than the same products exported from the United States.

In Thailand, repackaged dried fruits from Chile of prunes, raisins and apricots are on average 30%- 40% lower in cost than the same product and volume that would be exported from the United States. As an example, repackaged dried fruits from Chile retail at an average price of US$3.37 per 250 grams or US$5.81 for 500 grams, while U.S. exports of the same product have an average price of US$5.10 per 250 grams and US$12.16 for 500 grams. The primary price difference comes from U.S. exports receiving a 30% tariff on imports to Thailand, whereas Chile and Peru enter the market with no import tariff.

Exporting Processed Goods for F&B Production

Exporters that are seeking to maintain strong volumes in the face of lower-cost competition from Chile and Peru have opportunities in the food and beverage processing sector.

U.S. exporters that provide extracts of fruits for F&B processing face less competition from countries like Chile and Peru that have free trade agreements. This is due to the U.S. exports having greater consistency when integrating into products be they drinks, yogurts, biscuits or energy bars and having better processing capabilities to create extracts, powders and flakes that are used in production.

How Tractus Can Help

Identifying opportunities be they in retail or the F&B value chain requires primary research to identify the market trends and companies using products, and to qualify the highest potential opportunities. Tractus’ Strategy and Execution services can provide market research and partner identification to qualify these opportunities in Thailand and throughout ASEAN.

Trade Shows are buzzing with excitement after years of being dormant due to COVID protocols, and major shows across the region will be important venues to identify sales opportunities.

This article is authored by James Meisenheimer, Consulting Manager and Agro-Foods sector lead based in the Bangkok office of Tractus, a business strategy consulting and operations management firm dedicated to helping clients invest and thrive globally. Tractus is an Official Knowledge Partner of the Annual Investment Meeting.