The global landscape for Foreign Direct Investment (FDI) is at a critical juncture, especially in the context of climate change. As nations grapple with the pressing need for sustainable development, FDI emerges as a potent force that can reshape our approach to climate action.

AIM Congress explores the influential role of FDI, which is one of the six pillars of the event and falls under the umbrella of the Investment Track, in relation to the urgent need for action for decarbonization and the implementation of climate-friendly economic policies through sustainable investment initiatives.

Define Climate FDI Strategies in Relation to Climate GoalsUNCTAD’s ‘World Investment Report 2023’ underscores the critical role of FDI in reshaping our approach to climate change. To harness the full potential of FDI, countries must define robust climate FDI strategies aligned with climate goals. This involves creating a conducive investment environment prioritizing sustainability, renewable energy, and low-carbon technologies. The report notes that major oil companies are divesting fossil fuel assets at a rate of about $15 billion annually, freeing up resources for sustainable initiatives. This signifies a critical shift in investor sentiment. Governments and businesses must craft strategies that attract FDI specifically targeted at climate-related projects. With a 10% increase in the sustainable finance market to $5.8 trillion in 2022, there's a clear opportunity to steer FDI towards sustainable endeavours. |  |

Prioritize IPA Sector Targeting and Activities

Investment Promotion Agencies (IPAs) play a pivotal role in reshaping our climate approach through FDI. Countries can attract investments that contribute to climate mitigation and adaptation by prioritizing sector targeting and activities that emphasize sustainability.

A World Economic Form (WEC) report, ‘Towards a New Global Agreement to Facilitate Investment for Development,’ showcases Ghana's efforts, where the Ghana Investment Promotion Centre collaborates with the WEC to adopt sustainable investment standards. This involves tax legislation recognizing sustainable investors and offering them additional support and incentives. Countries can create an attractive investment climate by prioritizing IPA sector targeting aligned with sustainability.

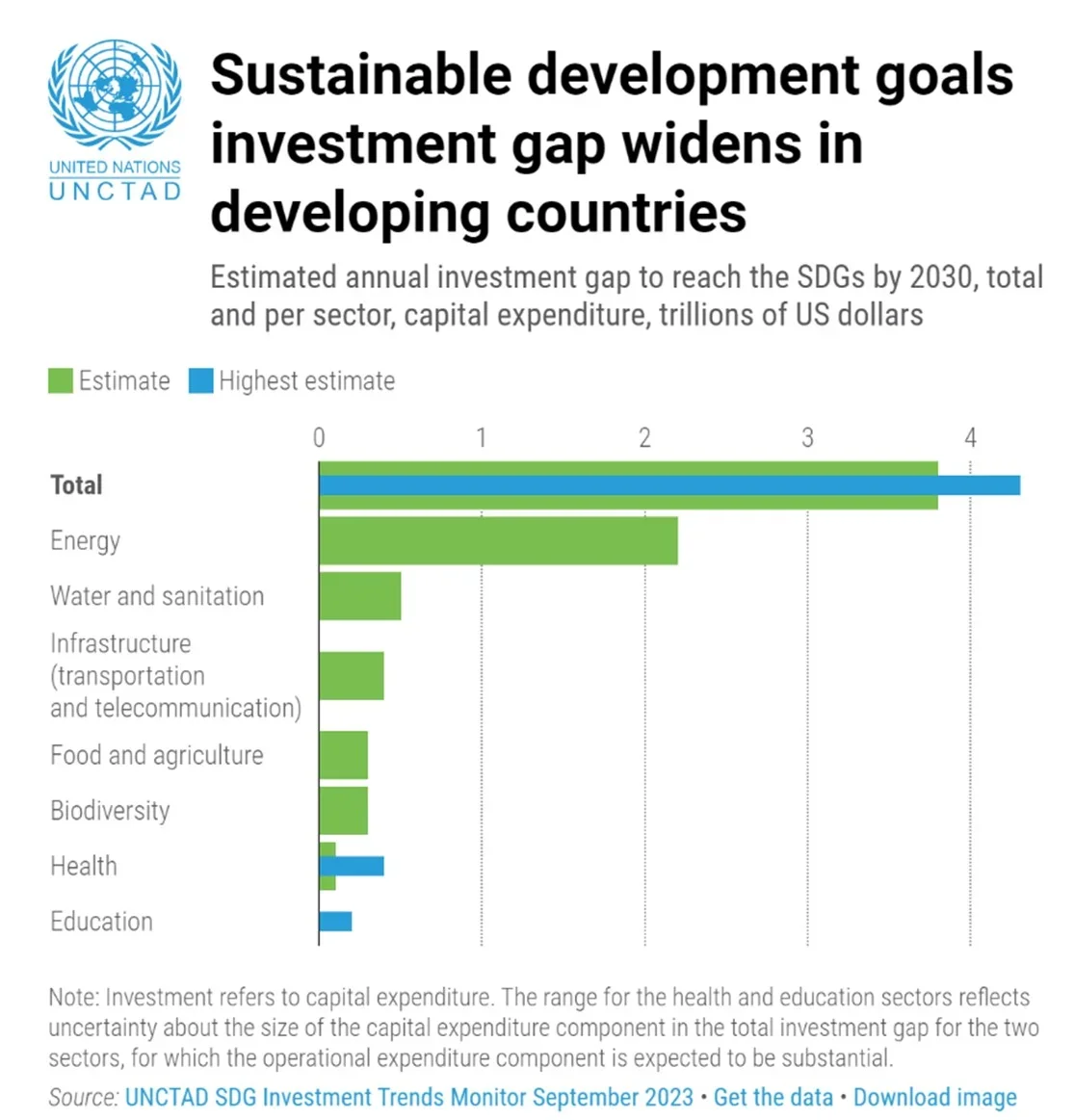

Meanwhile, the UNCTAD report highlights increased international investment in SDG sectors across developing countries, notably in infrastructure, energy, water, sanitation, agrifood systems, health, and education. Despite this, the widening SDG investment gap in developing countries has reached an alarming $4 trillion.

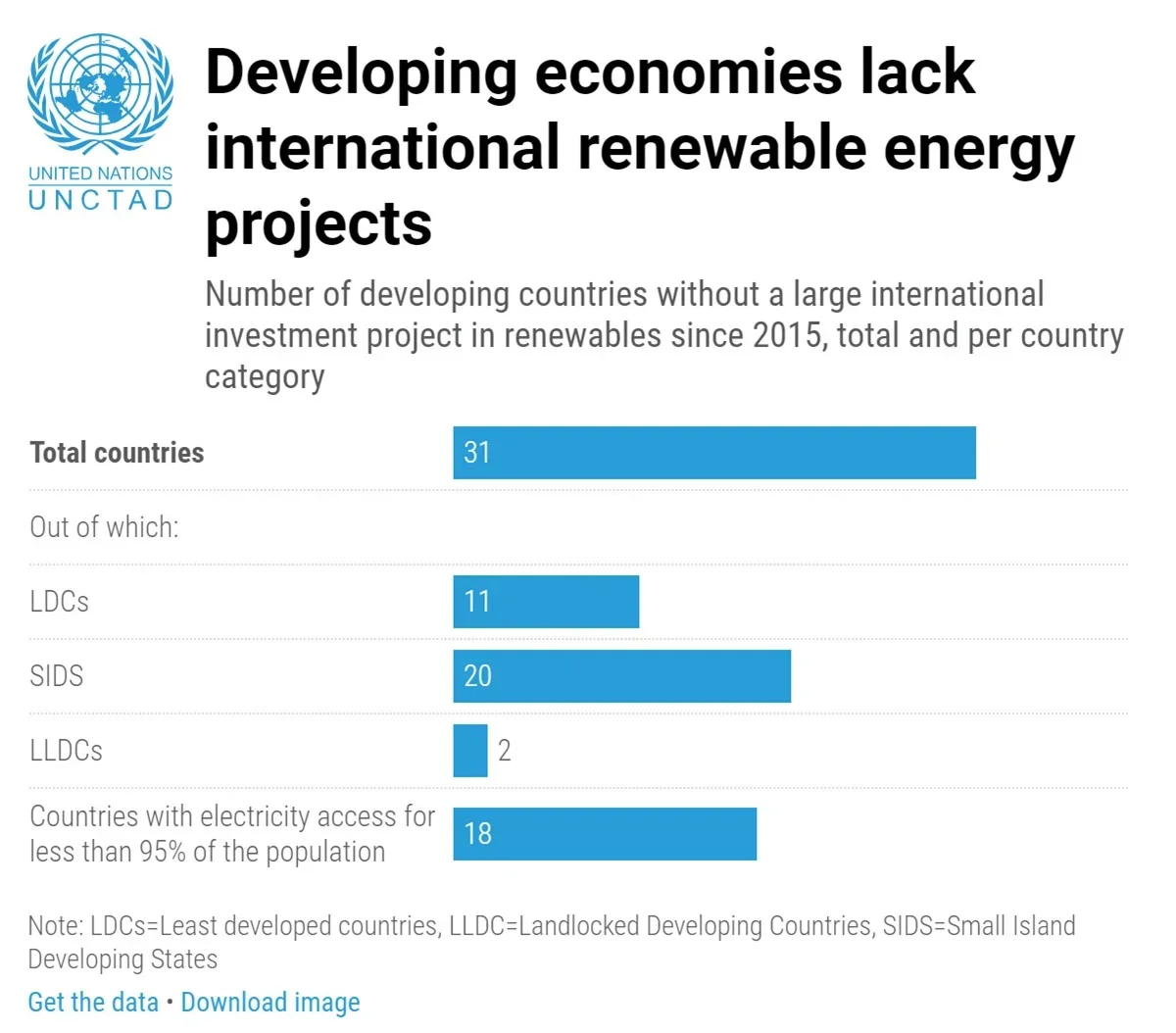

To address this disparity, Investment Promotion Agencies (IPAs) must tailor their activities to attract FDI in critical sectors. Developing renewable energy infrastructure, for instance, requires an estimated $2.2 trillion annually, yet in 2022, only $544 billion was invested, showcasing the pressing need for sector-focused FDI.

| Align Investment IncentivesAligning investment incentives with climate objectives is crucial for channeling FDI into sustainable ventures. Governments and regulatory bodies should offer financial benefits, tax breaks, and regulatory support to incentivize investments in renewable energy, water infrastructure, and sustainable agriculture. As per UNCTAD, the rise in green bond issuance to $3.3 trillion in 2022 signals increasing investor interest in sustainable initiatives. Leveraging this information, which forecasts an increase in green bond issuance in the coming years as economies surface from the negative effects of the Covid-19 pandemic, governments can create a conducive environment to attract FDI into climate-aligned projects. |

Development of Implementation Plans

Developing a robust implementation plan is essential for translating FDI intentions into tangible outcomes. An effective implementation plan should include clear targets, timelines, and mechanisms for monitoring and evaluating progress. Moreover, enhancing exposure to developing countries for institutional investors and addressing concerns related to greenwashing are crucial components of a comprehensive implementation strategy.

In Cambodia, the WEF, in partnership with the Council for the Development of Cambodia, has pioneered the creation of the first domestic supplier database with sustainability dimensions. This tool serves as a bridge, connecting foreign firms with local businesses committed to sustainable operations. By facilitating the match between environmental, social, and governance (ESG) capital and ESG investments, the database incentivizes local firms to adopt sustainable practices. Moreover, it aligns with Cambodia's new investment law, introduced in late 2021, which employs smart incentives for investments linked to development goals, thus promoting a more sustainable business environment.

According to WEF, Ghana's introduction of a "green channel" for imports and exports and a "red carpet" treatment for aftercare exemplifies a strategic implementation plan. Such measures not only encourage responsible business conduct but also contribute to the overall success of sustainable investments.

The AIM Congress 2024 will feature dynamic discussions on FDI and climate with engaging panels and fireside chats. "Unveiling FDI’s Power in Climate Financing" will explore the impact of FDI on climate finance, while "Leveraging FDI for Climate Change Mitigation" will spotlight sustainable investments in developing nations. The fireside chat, "Crafting Resilient and Sustainable Future Cities," will address urban resilience post-climate change and natural disasters. Additionally, the conference will delve into the outcomes and achievements of the United Nations Climate Change Conference (COP 28) and discuss the roadmap to COP 29, which will take place in Baku, Azerbaijan. These sessions promise insightful conversations on aligning FDI strategies with climate goals and building resilient, sustainable futures.