Foreign Direct Investment (FDI) plays a pivotal role in shaping the economic landscape of nations, with both opportunities and challenges accompanying its flows. As global integration faces disruptions and geopolitical tensions rise, the impact of FDI on emerging and developing economies comes into sharp focus. In this blog, AIM Congress takes a deep dive into the insights provided by the International Monetary Fund (IMF) and the 2023 Kearney FDI Confidence Index to explore the intricate dynamics that define the relationship between FDI and the economic fortunes of emerging and developing nations.

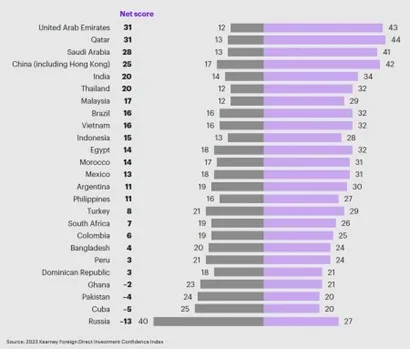

| Geo-Economic Fragmentation and VulnerabilitiesThe IMF report, "Fragmenting Foreign Direct Investment Hits Emerging Economies Hardest," underscores the vulnerabilities faced by emerging market and developing economies in the face of geoeconomic fragmentation. The report reveals that these economies are more susceptible to the relocation of FDI, a trend exacerbated by their reliance on flows from geopolitically distant countries. The decline in strategic FDI flows to Asian countries, except for China, since 2019 paints a nuanced picture of the challenges these nations confront. The Kearney FDI Confidence Index complements this narrative by highlighting the optimistic outlook of investors toward emerging economies. The Gulf Cooperation Council (GCC) countries, including the United Arab Emirates, Qatar, and Saudi Arabia, emerge as the most attractive destinations for investors. However, amid the promising prospects, it is crucial to dissect the potential risks and long-term consequences associated with FDI in these regions. Figure 1: In emerging markets, the FDI confidence is highest in the UAE, Qatar and Saudi Arabia |

Benefits and Challenges for Emerging Economies

The IMF report also sheds light on the multifaceted impact of FDI on emerging economies. While the entry of multinational corporations brings direct benefits to domestic firms, including technology transfers and increased local demand, the vulnerability to FDI relocation poses a significant risk. The report emphasizes that the relocation of FDI closer to source countries could hinder host economies by reducing access to capital and technological advances.

Moreover, the report points out that the benefits of FDI are more likely when foreign companies enter a country to produce inputs that are supplied to affiliated firms. This vertical FDI, such as the Samsung Electronics semiconductor factory in Vietnam, contributes to technology-intensive processes, benefiting both the investing company and the domestic economy.

The IMF report takes a step further by quantifying the potential long-term output losses for emerging market and developing economies. The estimated 2 percent reduction in global output underscores the magnitude of the challenge. This reduction is not evenly distributed, hitting these economies the hardest due to reduced access to investment from advanced economies, diminished capital formation, and lower productivity gains from technology transfers.

Kearney FDI Confidence Index

The Kearney FDI Confidence Index provides a snapshot of global investor sentiment. Despite discouraging factors like inflation and geopolitical turmoil, the majority of investors worldwide express their intent to boost FDI in the next three years. The index highlights the GCC countries as particularly attractive, with the United Arab Emirates leading the pack with a score of 31. Qatar is also on top with the same score while Saudi Arabia follows closely with a score of 28.

However, the positive sentiment is tempered by concerns about downsides, including commodity price increases and heightened geopolitical tensions. These concerns align with the IMF report's findings, emphasizing the need for a nuanced approach when navigating the complexities of FDI in emerging economies.

As emerging and developing economies stand at the crossroads of opportunities and challenges, policymakers must carefully balance the strategic motivations behind FDI with the potential economic costs. The IMF report emphasizes the importance of fostering global integration, especially as major economies endorse inward-looking policies.

Mitigating uncertainty is crucial, and multilateral actions should be taken to improve information sharing and facilitate international consultations on policy decisions related to FDI. A framework for addressing subsidies and incentivizing reshoring or friend-shoring of FDI could help governments make informed decisions and minimize unintended consequences.

All things considered, the impact of FDI on emerging and developing economies is a complex interplay of benefits and challenges. The insights from the IMF report and the Kearney FDI Confidence Index offer valuable perspectives on the current dynamics. While emerging economies hold promise for investors, understanding the potential risks and navigating the path forward with a strategic and informed approach will be key to ensuring sustainable economic growth and resilience in the face of global uncertainties.

AIM Congress 2024 and FDI

The AIM Congress 2024 stands out as a beacon for global economic prosperity, distinguished by its innovative features. In the investment track, under the theme, “Resilient, Sustainable Economic Growth: Creating a Healthy and Prospective Investment through FDI and FPI,” the key focus will be on FDI, one of the six pillars of AIM Congress 2024.

The AIM Congress 2024 is set to be an unparalleled convergence of industry leaders and visionaries, featuring comprehensive offerings across diverse sectors such as Technology, Energy, Finance, Agriculture, Healthcare, Manufacturing, and Transportation. This dynamic event will encompass Workshops, Conferences, Exhibitions, Awards, Investors Hub, Investment Destination showcases, and specialized Regional Focus Forums. Facilitating critical connections, the congress will also host Government-to-Government (G2G), Government-to-Business (G2B), and Business-to-Business (B2B) meetings, fostering collaborative opportunities. With an expansive array of features, AIM Congress 2024 promises an immersive experience, driving innovation, investment, and transformative dialogues across the global business landscape.

Supported by the UAE Ministry of Industry and Advanced Technology and partnered with the Abu Dhabi Department of Economic Development, AIM Congress 2024 invites stakeholders from around the world to participate in this unparalleled convergence of global leaders and visionaries, taking place in Abu Dhabi from May 7 to 9, 2024. The event promises to be a catalyst for economic growth and expansion, offering a unique opportunity to foster collaboration and address global challenges for the benefit of nations worldwide.