The digital economy has fundamentally transformed how we interact and conduct business. However, challenges like inefficiency, lack of transparency, and security vulnerabilities continue to plague traditional online systems. This is where blockchain technology emerges as a potential game-changer, poised to revolutionize trust and transactions in the digital age.

The Problem: Friction and Fragility in the Digital Age

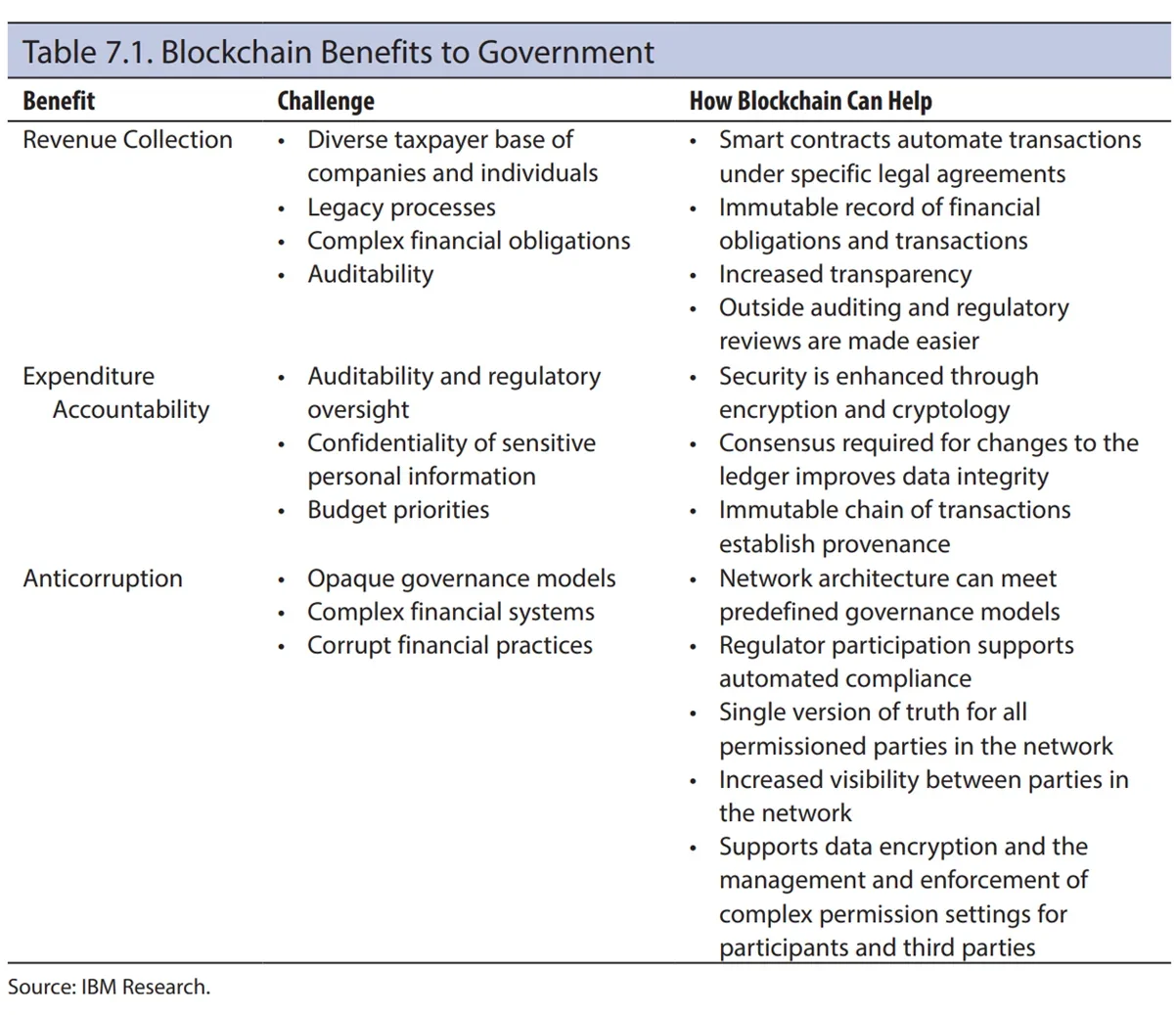

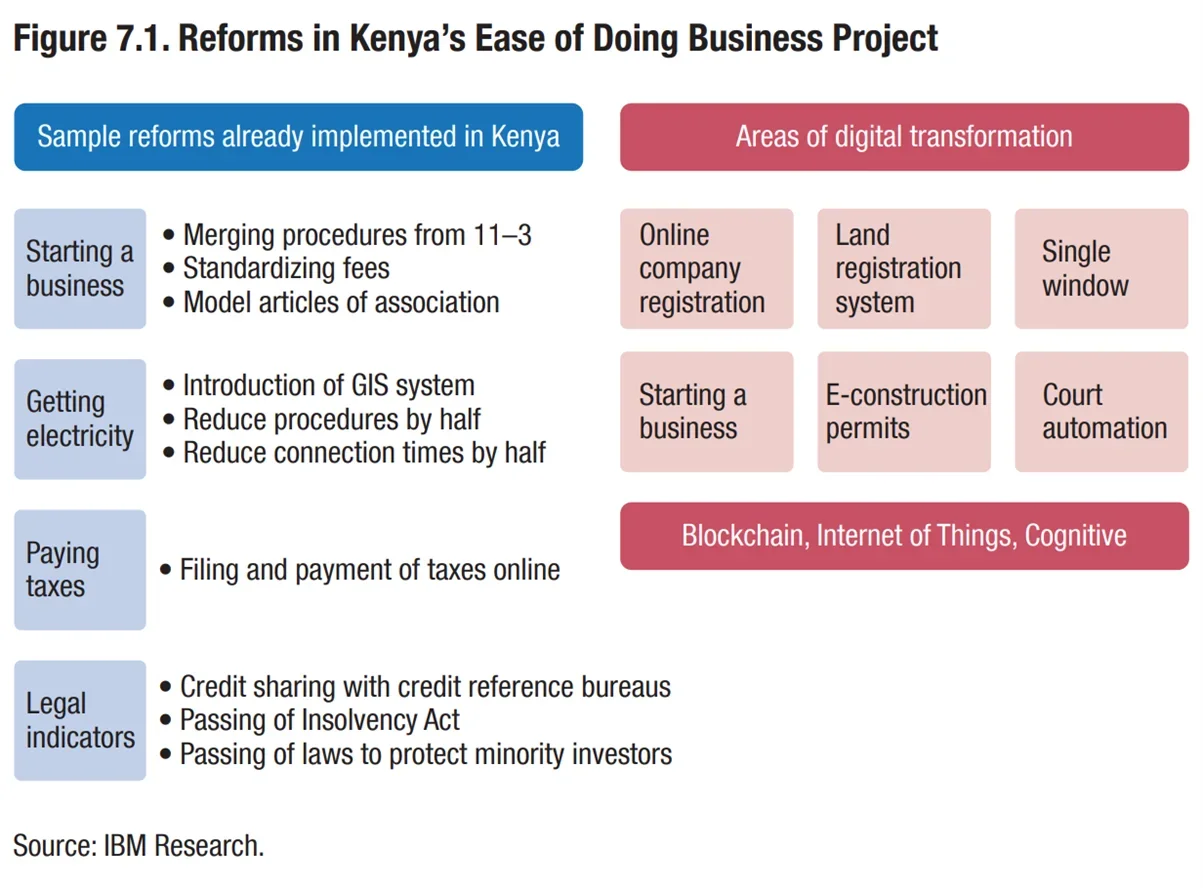

As highlighted by the International Monetary Fund (IMF) report on "Digital revolutions in public finance," current government transaction systems are often slow, paper-based, and prone to errors and fraud. This inefficiency creates a barrier to trade and hinders the delivery of essential services. Similarly, the McKinsey & Company article "How blockchains could change the world" emphasizes the dominance of powerful intermediaries in various industries. Banks control financial transactions, record labels dictate music distribution, and governments manage land ownership records – all with inherent limitations and potential for manipulation.

The Promise of Blockchain: Transparency, Security, and Efficiency

Blockchain technology offers a solution to these challenges. It functions as a distributed ledger – a secure, transparent, and tamper-proof record of transactions shared across a network of computers. Every transaction is chronologically added to a "block," and these blocks are chained together, creating an immutable record. According to the IMF report, blockchain can establish secure digital identities for citizens, track the provenance of goods to prevent counterfeiting, and automate tax collection, reducing errors and fraud.

Reimagining Industries: From Finance to Identity Management

The potential applications of blockchain extend far beyond traditional finance. As Tapscott Group CEO Don Tapscott argues in the McKinsey & Company article, blockchain can disrupt numerous industries by enabling peer-to-peer transactions without the need for intermediaries. In the financial sector, blockchain could lead to faster, cheaper, and more secure transactions, potentially bypassing the need for banks. The music industry could see a transformation where musicians can directly sell their work to fans through smart contracts, automated agreements that execute based on predefined conditions. This could lead to fairer compensation for artists who currently face challenges with traditional music distribution models, according to Tapscott.

Beyond financial transactions, blockchain can revolutionize identity management. Imagine a system where each individual has a secure digital identity stored on a blockchain. This identity could be used for various purposes, such as accessing government services or verifying credentials for employment. Importantly, this system would empower individuals with greater control over their data, ensuring privacy through selective disclosure.

Challenges and the Road Ahead

Despite its immense potential, blockchain technology faces several challenges. As highlighted by the IMF report, the initial investment in blockchain infrastructure can be significant. Additionally, transitioning to a blockchain-based system often requires cooperation between public and private entities, necessitating policy changes and legal frameworks to address the unique features of this technology. Concerns around energy consumption associated with cryptocurrency mining and the potential for new security vulnerabilities also require attention, as highlighted by both the IMF report and the McKinsey & Company article.

Building a Secure and Equitable Future

The successful implementation of blockchain requires careful planning and collaboration between governments, businesses, and individuals. As the IMF report suggests, careful legal assessments, impact determination, and capacity development are crucial for successful government adoption of blockchain technology. On a broader level, fostering open dialogue and collaboration between stakeholders is essential to address concerns around governance and develop a regulatory framework that promotes innovation while mitigating risks.

In conclusion, blockchain technology presents a transformative opportunity for the digital economy. By fostering trust, transparency, and efficiency in transactions, blockchain has the potential to disrupt numerous industries and empower individuals. While challenges exist, by working together, we can navigate them and unlock the vast potential of blockchain to build a more secure, equitable, and prosperous digital future.

Future of Finance and AIM Congress 2024

At the 2024 AIM Congress, the Future Finance Forums' Track will feature dedicated sessions and talks exploring the transformative potential of Blockchain technology. Under the theme of Blockchain and the Digital Economy: Revolutionizing Trust and Transactions, these sessions will unpack how blockchain disrupts traditional systems, fosters transparency and security, and creates a more efficient digital landscape.

Join leading experts and industry figures to understand how blockchain can empower individuals, redefine industries, and unlock a new era of global economic growth. AIM Congress 2024 provides a premier platform for this critical conversation, making it a must-attend event for anyone invested in the future of finance.