The current environment in China imposes different impacts on local and foreign companies, fueled not only by the previously stringent Zero-Covid policy, but also by the fears signaled throughout the Chinese market. In the increasingly complex investment environment, there exist a host of challenges investors must navigate, from the contraction of the economy and doubts about the sustainability of demand to geopolitical issues that heighten the fear of price increases and the instability of emerging markets. Supply chain disruptions underscore a potential decoupling reflected in the push from Chinese authorities to use the Renminbi in international transactions and advance digitalization of the economy. Moreover, labor challenges and protectionism contribute to a precarious investment environment, alongside increasingly strict regulations on cybersecurity, data, and personal information protection.

However, not everything is negative for the companies already located in China; tax reductions, import/export regulatory relaxation, and internal regulations on dormancy gave some air to struggling companies.

Doubting Demand

After ending its Zero-COVID policy in January 2023, and gradually restoring its VISA policies, China expected to see a rebound in its economy— an expectation that was placed entirely on the appetite of the Chinese consumer, to unleash their expenditures and restart travel, at least domestically.

During the extended May 1 Chinese holiday, 274 million domestic trips caused tourism revenues to reach about US$ 21.44 Billion, surging 123% from last year, according to information from the Ministry of Culture and Tourism. Meanwhile, China’s retail sales of consumer goods rose 5.8% year-on-year to 11.49 trillion yuan (US$ 1.67 trillion) in the first quarter, per the National Bureau of Statistics.

But the reality is quite different from the expectations for Western companies in the country, many of which have reported reductions in their earnings. According to The Motley Fool, “Starbucks said that economic growth in China had started to slow, especially with regard to international travel. Finnair dittoed that notion, adding that the nation’s recovery has proven ‘slower than many anticipated,’ while Hilton said ‘China won’t contribute’ what the company had hoped.”

This is not the first time that apparently contradictory information has come from local and foreign sources, because everyone sees the marketplace according to how they prosper. Foreign companies talk about Q1 of 2023, whereas China Daily offers a new vision from May 2023 starting. Despite this May peak, until now, the most trusted information from Peoples Bank of China, included in Rhodium’s China Pathfinder Report, indicates that Chinese households have been placing a record 15 trillion RMB in long-term time deposits. This fact indicates that Chinese consumers may be building their savings in the face of an uncertain future.

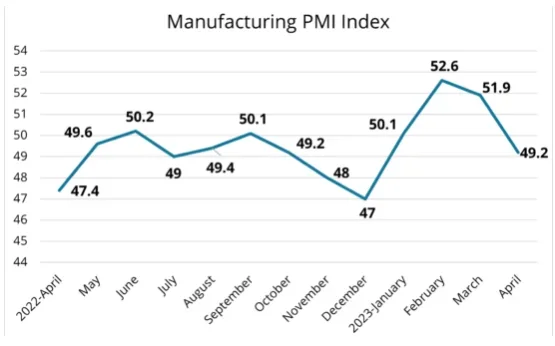

The results from 2023 Q1 translate into a downturn in factories’ activities. According to data from the National Bureau of Statistics, the official manufacturing purchasing managers’ index (PMI) shrank by 2.7 points in March, from 51.9 to 49.2, marking the first contraction of the new year, on par with similar contractions seen throughout 2022. The weakness in factory output echoes the slowdown in global growth, even as it contrasts with the services consumption that fueled the economy in the first quarter. The slowdown in conjunction with the growth of savings in banks is raising doubts about the sustainability of the demand.

Geopolitical Tensions & Continued Decoupling

According to Kearney Global Business Policy Council, in their publication for “The 2023 FDI Confidence Index”, the risks that global investors most fear are price increases, the rise of geopolitical tensions and political instability, followed by economic crisis in developed and emerging markets.

There exist specific pressure factors on China. Without forgetting the escalation of the Russia-Ukraine war, posing risks to the global economy and trade, a strong dollar imposes ‘exports’ inflation on the rest of the global economy. In place of the U.S. dollar, Chinese authorities are lobbying worldwide to use the Renminbi for transactions with China, deepening tensions between the two economies. Chinese authorities are also expediting use of the electronic Renminbi, with several local city governments starting to pay civil servants in digital yuan. The Chinese IT and technological advances promote intensified U.S. controls on exports to China and investment screening – particularly regarding sensitive technologies – and geopolitical risks related to Taiwan.

One REUTERS ARTICLE explains how Chinese exports soared in March, “driven by strong shipments of solar products, new-energy vehicles and lithium batteries and as supply chain conditions continued to improve from their COVID paralysis.” However, the happiness for Chinese manufacturers ran short, as the U.S. Senate voted on May 3 to reimpose tariffs on solar panels from Chinese companies after they were discovered to have been routed through Southeast Asian factories to avoid tariffs. This is just one example of some of the risks imposed by the trade tensions between China and the United States that are anticipated to continue escalating in the proximity of the American elections.

However, recent efforts to stabilize the two countries’ relationship may inspire cautious optimism in foreign investors. U.S. Secretary of State Anthony Blinken’s June visit to Beijing signals a willingness to explore areas of potential collaboration and ease tensions—or at least prevent further escalation.

Challenges in the Labor Force

Some of these concerns were reflected in the results from AmCham China’s 2023 China Business Climate Survey Report, where American companies located in China reported their top five challenges in China being: (1) Rising tensions in U.S.-China relations (66%), (2) COVID-19 prevention measures (55%), (3) Inconsistent regulatory interpretation and unclear laws & enforcement (32%), (4) Rising labor costs (25%), and (5) Regulatory compliance risks (25%). The AmCham report touches on a critical factor that is increasingly worrisome: the labor force. In addition to the difficulty of obtaining a visa/working permit, companies face significant challenges in recruiting and retaining expatriates to work in China for a variety of reasons. According to the AmCham survey, qualified candidates being unwilling or unable to move to China, bilateral tensions and other geopolitical concerns, slowing of the Chinese economy, individual income tax regulations, high cost of living and payroll costs, and internet/media censorship all present major challenges for international companies. Even among local talent there is an increase in unemployment, with the rise of the “Lay Flat” movement that has seen many young graduates rejecting the pressure of a highly demanding work environment, opting instead for a slower-paced lifestyle buttressed by savings and parental support. This movement has been censured by the government, which exalts the virtues of manual work in an effort to attract the workforce into the lower echelons of the manufacturing scale. This may impose closer future regulations that tighten access to universities in favor of technical curriculums.

Furthermore, as labor costs rise, China’s viability as an affordable manufacturing hub has diminished, resulting in investors departing for lower cost manufacturing countries, such as Vietnam. Its robust domestic market, however, is attractive all on its own—leading other companies to adopt a “China-plus-one” strategy to cater to both Chinese and international markets, a trend that began even before the U.S.-China trade war. Even with some worried about the country’s ability to maintain the recent surge in demand, China’s immense domestic consumer base is incomparable. With the right strategy, investors pursuing China for China can expect to see continued returns.

Competing Protectionism Measures

On protectionism, China is moving in two directions, both indirectly strengthening protectionism using bidding control on public sector demand and, on the other hand, relaxing regulations for importers.

- Measures relaxation: Last December, the Ministry of Commerce (MOFCOM) and the General Administration of Customs (GAC) jointly published the updated catalogs of goods subject to automatic import licensing and import licensing on an annual basis, and catalogues of goods that are prohibited or temporarily restricted from import, as well as the list of export goods that require licenses on an annual basis. With these new regulations, foreign companies operating import and export businesses in China benefit from simplified registration procedures and lower tariffs.

- Strengthening Protectionism: The Chinese government is encouraging localization. State-owned enterprises are reducing the percentage of foreign products in their procurement processes. Certain sectors, including medical devices, data processing, and other high-tech fields, will be increasingly inaccessible to foreign exporters.

The Chinese government is fair in their regulations for companies incorporated in their territory, at least on paper. Beyond restrictions on investment in some critical sectors, any company incorporated in China will receive similar treatment independent of its ownership, whether Chinese or foreign. China’s business environment has always been a relationship battlefield, with Chinese companies notoriously better positioned on the ground, but anticorruption campaigns have been working tirelessly to eliminate personal considerations in the public sector.

Stricter Regulations

Companies in China, or dealing with China, need to pay special attention to the strengthening of regulations on cybersecurity, data, and personal information protection. Every company needs to comply with the new legal framework and regulatory requirements regarding cross-border data transfers, cybersecurity, and data protection.

When China started to apply stricter environmental regulations to achieve its carbon-neutral plans, many companies became affected by relocations. Several chose to exit the country for more relaxed jurisdictions. Others began implementing ESG plans, and by 2018, when everything started to normalize, there appeared a new threat in the form of tariff escalation from the U.S.-China trade tensions. In addition, from the end of 2019 until this year, the pandemic crisis continued to hurt the supply chain between the markets. These factors are initiating the potential decoupling between the two largest economies in the world, which is hurting terribly the foreign companies in China, as they are forced to maintain ties across both sides of the ocean. To alleviate the COVID-19 impact on local and foreign-owned enterprises in China, the Chinese government has promulgated several tax reductions, including for value added tax (VAT) and corporate income tax (CIT), as well as several reductions in the Social Security contribution for employees, which have contributed to helping with workforce retention.

In 2022, due to the pandemic, many companies were forced to halt production for long periods, to the point of incurring unrecoverable losses. While some had to ultimately close their doors, the Chinese government in that year made a novel move in approving a regulation allowing companies to become dormant. With this new regulation, companies can be inactive for up to three years, during which time they can reduce or eliminate staff and assets, including real estate, and retain rights to their IP. On the other hand, if they exit the market, returning in the future will be expensive, and their IP rights may be gone. For small companies that rent factories, this change is insignificant, but medium and large companies that entered crisis during the pandemic can benefit greatly.

This article is authored by Herminio Andres, lead manager for the Business Inc.ubator® practice and General Manager for the China Office of Tractus, a business strategy consulting and operations management firm dedicated to helping clients invest and thrive globally. Tractus is an Official Knowledge Partner of the Annual Investment Meeting.