As the global business landscape undergoes a transformative shift, sustainable investing is emerging as a crucial paradigm with a focus on environmental, social, and governance (ESG) factors. In this exploration of sustainable investing trends for the next decade, we delve into three key areas: responsible resource utilization, the ESG surge, and the influential role of millennials.

Resource Responsibly: Decarbonization Race and the Imperative for Sustainable Land Use

The urgency to combat climate change has ignited a decarbonization race globally, compelling countries and industries to reduce their carbon footprint. This race underscores the need for sustainable land use and responsible mining practices for renewable energy, propelling critical shifts by 2030.

Several prominent companies are making significant strides towards carbon neutrality and sustainability. As per Sustainability Magazine, JetBlue achieved carbon neutrality on all domestic flights, offsetting emissions and investing in sustainable aviation fuel. Shell is targeting net-zero by 2050, incorporating nature-based solutions to offset emissions. Microsoft aims to be carbon negative by 2030, implementing renewable energy and internal carbon fees. Alphabet, Google's parent company, claims a net-zero carbon impact since 2007 through offset purchases and $5 billion in clean energy investments. Delta has committed to carbon neutrality by 2050 and sustainable aviation fuel by 2030. General Motors plans carbon neutrality by 2040, emphasizing zero-emissions vehicles.

For investors, the call to align portfolios with companies contributing to decarbonization and embracing sustainable practices is evident. Investing for profit has turned into investing in ESG and also profit. AIM Congress (Annual Investment Meeting), to be held at Abu Dhabi National Exhibition Centre from May 7-9, 2024, will play a pivotal role in fostering such alignments by bring together governments, SMEs, startups, and investors from across the globe to address these challenges.

ESG Surge: The Catalyst for Enhanced Corporate Disclosures

Environmental, social, and governance (ESG) factors have become integral in evaluating a company's long-term sustainability and risk profile. Over the next decade, a surge in sustainable financial roles can be anticipated, which will be driven by heightened investor expectations for improved corporate ESG disclosures.

Investors are becoming increasingly discerning, seeking companies that generate financial returns while demonstrating a commitment to ESG principles. Companies are responding by enhancing ESG disclosures, adopting standardized reporting frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB).

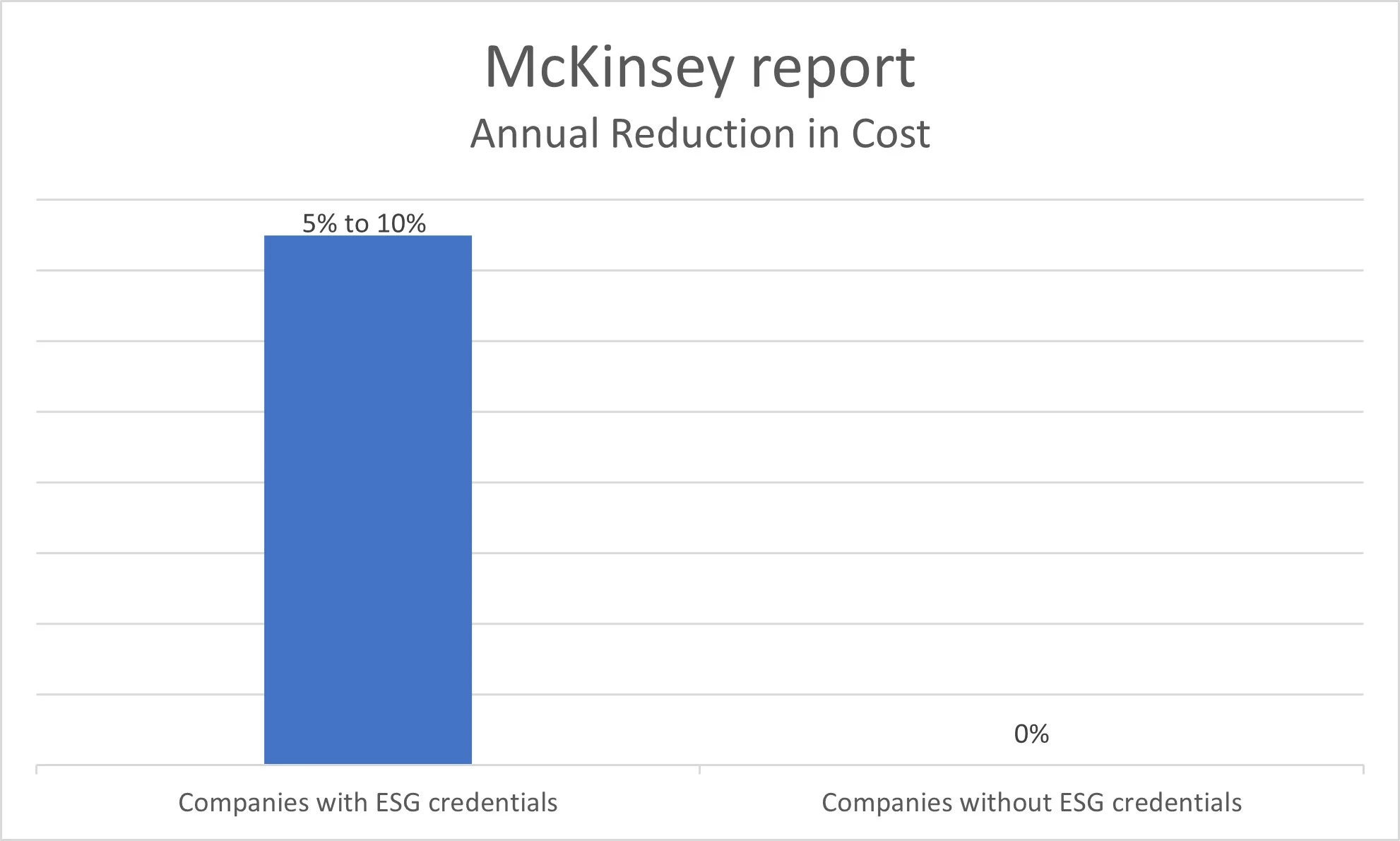

In fact, as per McKinsey's findings, enterprises boasting robust ESG (Environmental, Social, and Governance) credentials experience cost savings ranging from 5% to 10%.

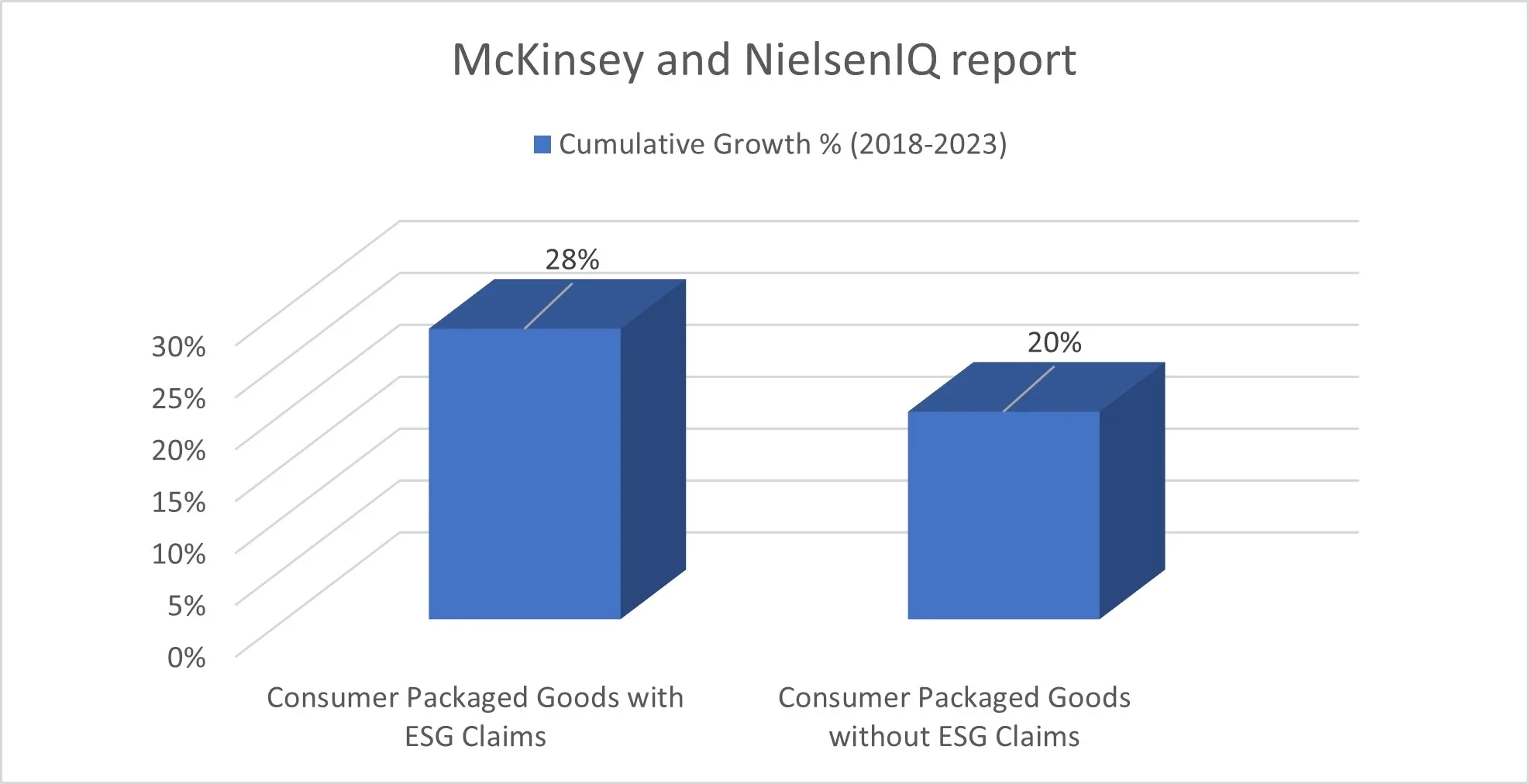

Furthermore, leading ESG performers witness a substantial 10-20% increase in value compared to their competitors. An apt example is FedEx, actively pursuing the conversion of its 35,000-vehicle fleet to electric or hybrid engines. Presently, in the first half of 2023, 20% of the fleet has been successfully converted, resulting in a notable reduction of over 50 million gallons in fuel consumption.

The annual AIM Congress acts as a catalyst in this regard, connecting governments with other governments, governments with other businesses, while also businesses with other business. The three-day event provides a platform for one-on-one discussions, increasing the chances of meaningful collaborations and partnerships leading to increased ESG investing.

Generational Shift: Millennials at the Helm of Sustainable Investing

The surge in sustainable investing is also significantly driven by a generational shift, with millennials leading the charge. Born between 1981 and 1996, millennials are reshaping financial markets with a purpose-driven approach, emphasizing social, environmental, and ethical considerations.

Impact investing, wherein investors actively seek opportunities for positive social and environmental outcomes alongside financial returns, has gained prominence due to millennial values. The tech-savvy nature of millennials has further catalyzed the rise of robo-advisors and digital investment platforms, democratizing sustainable investing.

As millennials accumulate wealth and influence financial markets, sustainable investing is becoming mainstream. AIM Congress, as a global initiative, aligns with the values of millennials by emphasizing the importance of sustainability and ethical considerations in investment decisions. In fact, AIM Congress throughout its 11-year legacy has played a key role in shaping the future of investment by championing sustainability as one its key paths towards global economic development.

Join us at the 2024 AIM Congress and be a driving force in shaping the future of sustainable investments!