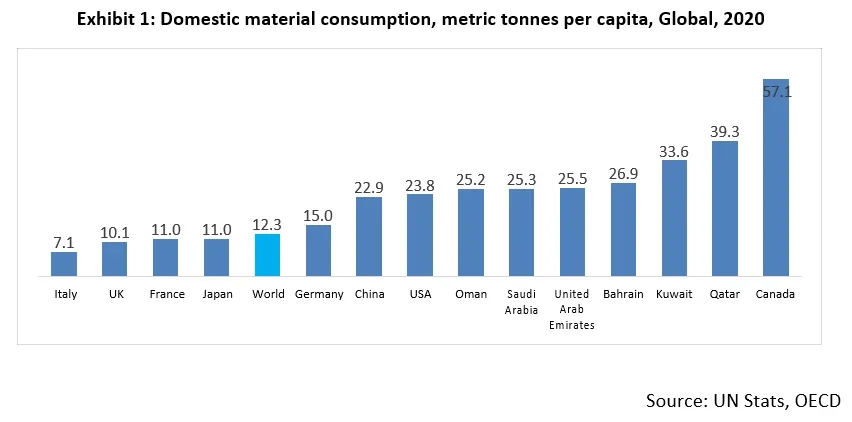

Globally, governments and private industries are finding innovative methods to shift to circular economy models for sustainable growth. High domestic material consumption and inadequate end- of-life waste management practices have resulted in poor material efficiency. Circular business models operate differently from traditional linear models. They enable creating products that can be disassembled, reused, and recycled, by using materials and products for as long as possible, and by substituting physical products with digital ones. They reduce the environmental impact of operations and facilitate the development of a more sustainable future. Several initiatives have been launched globally to promote circular economy and the most prominent ones are the United Nations Sustainable Development Goals, the Paris Accord (United Nations Framework Convention on Climate Change), the Global Reporting Initiative and the European Union (EU) Green Deal.

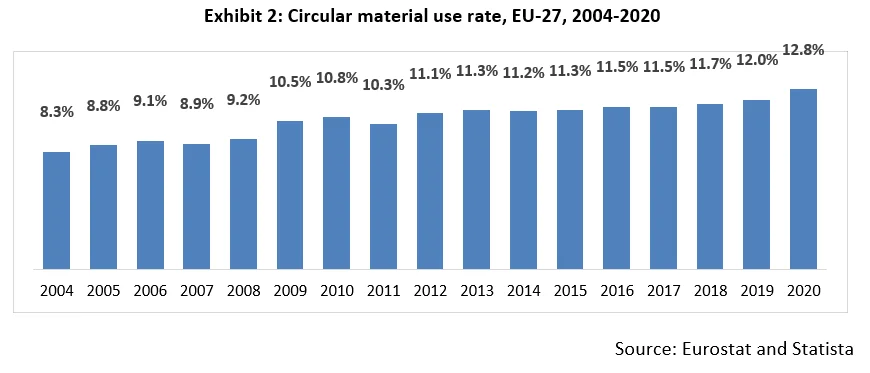

Europe is the forerunner in the adoption of circular business models and has developed policies and initiatives to implement it. Circular Economy Action Plan I, launched in 2015, was one of the major early initiatives to promote circularity. Such initiatives in Europe have resulted in the adoption of circular materials across member countries.

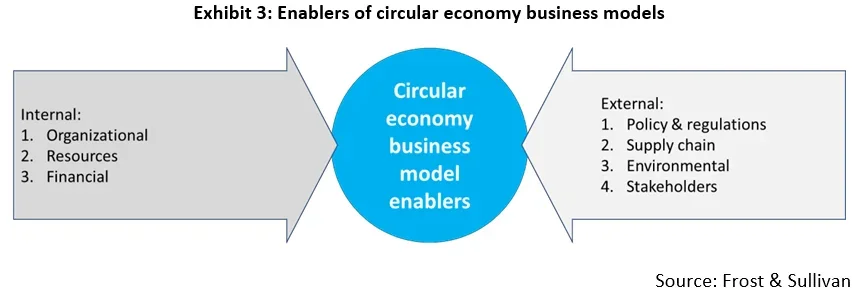

Various factors have contributed to the adoption of circular economy concepts and business models over the years in Europe. These factors are both internal and external to the organizations.

Internal Adoption Enablers

• Organizational: These are factors that motivate an organization to implement circular economy, such as good leadership, design strategies, innovation, research and development and organisational infrastructure. Leadership is considered the primary and most critical element that drives the successful implementation of a business model.

• Resources: Various resources such as materials, knowledge, and technologies are essential elements of circular economy business models, because it aims for a regenerative production system and sustains resource circulation within a closed system. This reduces the demand for new material and improves material efficiency. Digital solutions such as Big Data analytics and Internet of Things (IoT) provide a competitive edge to companies adopting circular business models.

• Financial: The current "make-use-discard" linear model is expensive and difficult to sustain in terms of resources. The possibility of reducing material costs is a key enabler for circular economy models. Another factor is the availability of green technology funds and financing support for start-up companies that implement circular business models.

External Adoption Enablers

• Policy & regulations: National and international policies are important drivers of circular models. Various elements such as taxation, supporting funds (loans and credits), and subsidy policies enable circular business model transition in an economy.

• Supply chain: Diversification of supply chain partners could enable geographical proximity would facilitate collaborations in the value chain and promote resource availability for implementing circular models.

• Environmental: Circular business model's key objective is to reduce the negative impact on the environment. Reduced operational risks and improved environmental safety are key enablers.

• Stakeholders: Due to increasing awareness of sustainability among end consumers, organisations should consider more responsible production and consumption methods and opt for circular models.

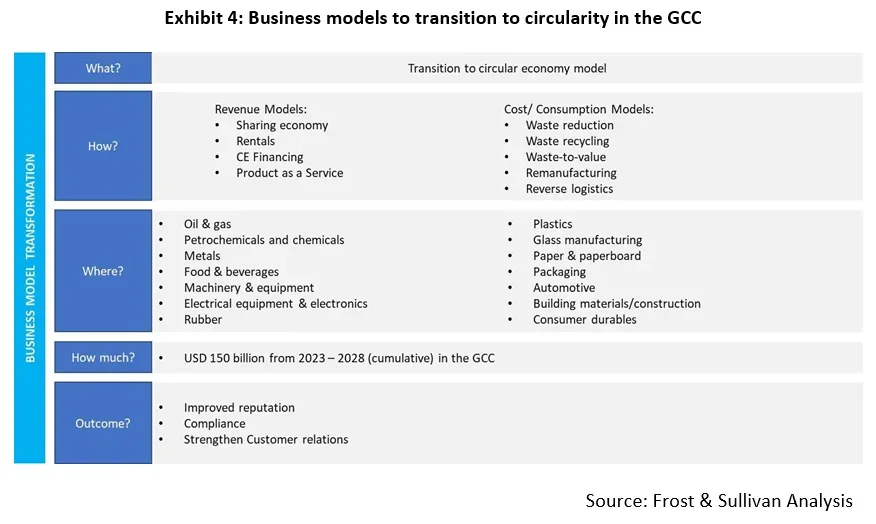

The Gulf Cooperation Council (GCC) along with many nations in Europe, Asia, and the United States has sought a shift to circular models for improving resource efficiency, reducing costs, and supporting economic diversification. This shift will prevent the depletion of the planet's finite resources and minimise the impact on the environment. Given that the domestic material consumption rate in the GCC is 2 to 3 times greater than the world average, the region has a strong potential for circular economy models. Today's linear economy models, which are prevalent throughout the GCC, are anticipated to undergo a radical change, spurred by initiatives such as UAE's Circular Economy Policy and KSA's Circular Carbon Economy Plans. GCC countries are adopting circular economy models and realising this shift depends on lowering resource consumption, extending product lifespans on a larger scale, reusing, and recycling materials, and implementing innovative business and consumption models.

Key circular economy business models that could be adopted in the GCC include:

Sharing economy: "Everything-as-a-service" is a mega trend the GCC can benefit from. It would encourage the incubation of services that result in an increase in sharing.

• Rentals: Business solutions that encourage renting out products and services, for example car sharing in automotive segment.

• CE financing: The move towards circular models requires adequate availability of supporting services such as banking & financial services and insurance. The GCC can take a lead in this by becoming the global hub for circular economy financing.

• Waste reduction: Through less wastage in the manufacturing process–scrap/pre-consumer waste is all reused/recycled–losses in manufacturing can be reduced. CE concepts can be adopted to achieve innovations in products/services, for example. three-dimensional (3D) printing can be used to eliminate waste.

• Waste recycling: In the GCC, end-of-life waste management is the most crucial component of circular economy. For instance, employing post-consumer garbage as a resource might not only save costs because there is undoubtedly a ready supply of waste, but it can also draw in new customers because more and more customers are becoming ecologically sensitive about the products they buy on an annual basis.

• Waste-to-value: Solid waste management has become a major concern in the GCC region.

The existing landfilling strategies will not suffice to handle this increase. The GCC is making a shift towards integrated waste management, with an emphasis on "waste-to-value" methods such as a waste-to-energy.

• Remanufacturing: The GCC enjoys a significant advantage in the ports and logistics sector.

This can be leveraged to increase the import of high value products that can benefit from life extension through refurbishment/remanufacturing.

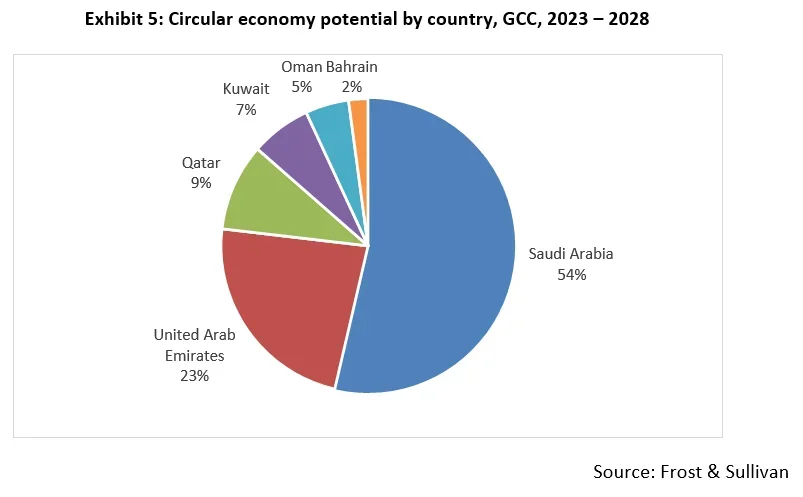

The GCC region's circular economy potential is estimated to be USD 150 billion from 2023–2028 in the manufacturing and non-manufacturing sectors. The top markets for circular business models in the region are the KSA and the UAE with a combined potential of USD 120 billion. Challenges must be overcome as the GCC tries to accept this new paradigm to achieve best practices in sustainability, both locally and globally, through the promotion of new business models.

Even though there are active circular initiatives and projects all over the GCC, market potential has not yet been completely realised. Policy intervention and targeted action on priority issues would be beneficial in maximising market potential and addressing current impediments to conducting business in the region. However, such actions need to be carefully planned in accordance with national conditions and local contexts.

Disclaimer

Frost & Sullivan is not responsible for any incorrect information supplied by companies or users. Quantitative market information is based primarily on interviews and therefore is subject to fluctuation. Frost & Sullivan research services are limited publications containing valuable market information provided to a select group of customers. Customers acknowledge, when ordering or downloading, that Frost & Sullivan research services are for internal use and not for general publication or disclosure to third parties. No part of this research service may be given, lent, resold, or disclosed to noncustomers without written permission. Furthermore, no part may be reproduced, stored in a retrieval system, or transmitted in any form or by any means—electronic, mechanical, photocopying, recording, or otherwise—without the permission of the publisher.

This article is authored by Nideshna Varatharajan, Senior Consultant – Energy & Environment Practice, Frost & Sullivan, which has six decades of experience analyzing industry transformation and identifying innovative growth opportunities. Frost & Sullivan is an Official Knowledge Partner of the Annual Investment Meeting.